Private Equity Fund Structure Diagram

Private equity fund structure private equity funds are closed end investment vehicles which means that there is a limited window to raise funds and once this window has expired no further funds can be raised. Of private equity fund formation.

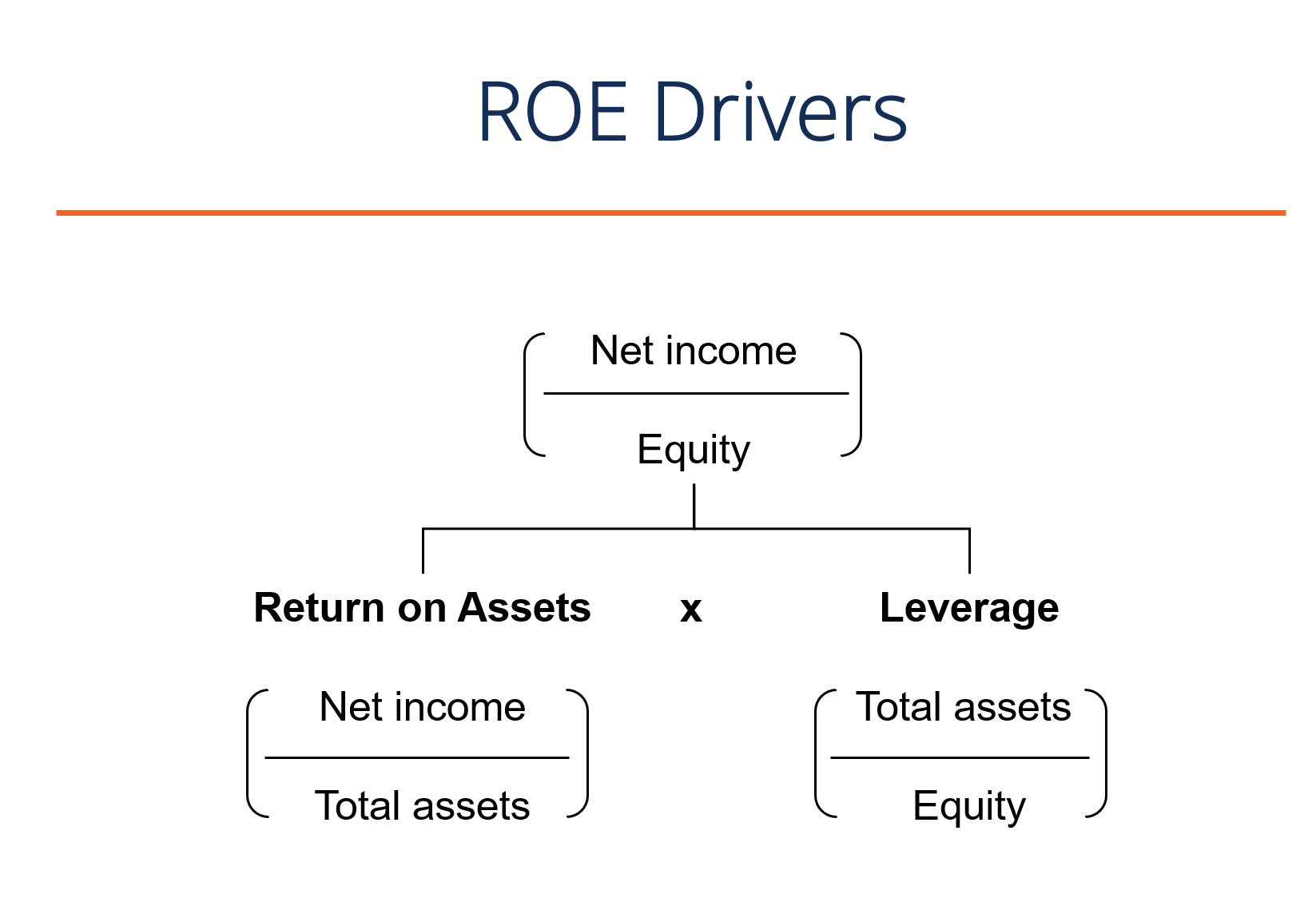

Diagram Of Equity Catalogue Of Schemas

Diagram Of Equity Catalogue Of Schemas

Note that successful private equity firms typically look to raise multiple successive funds.

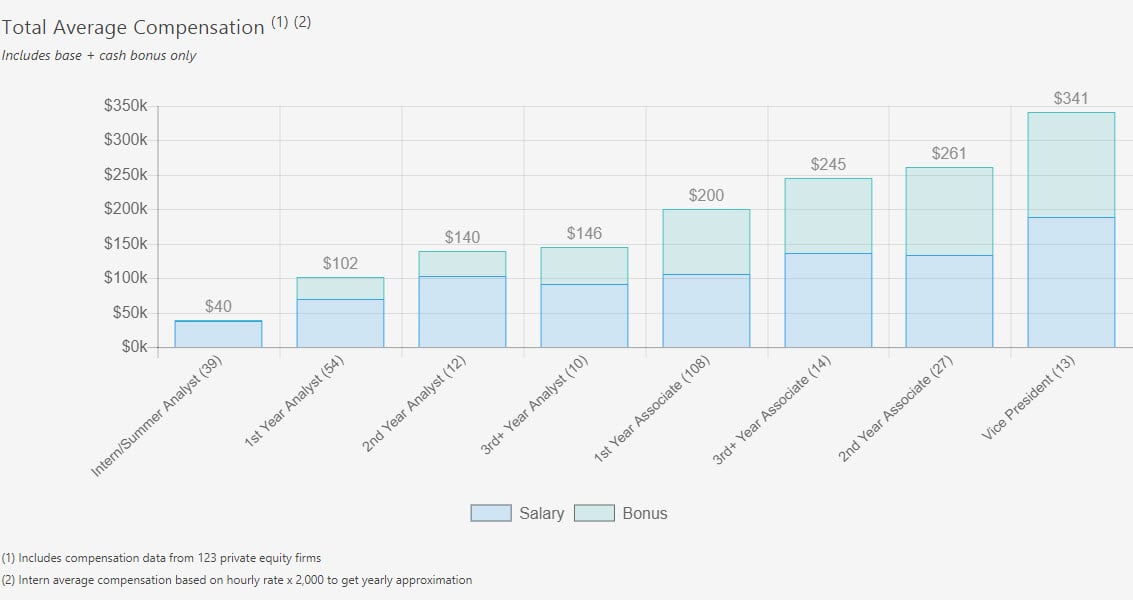

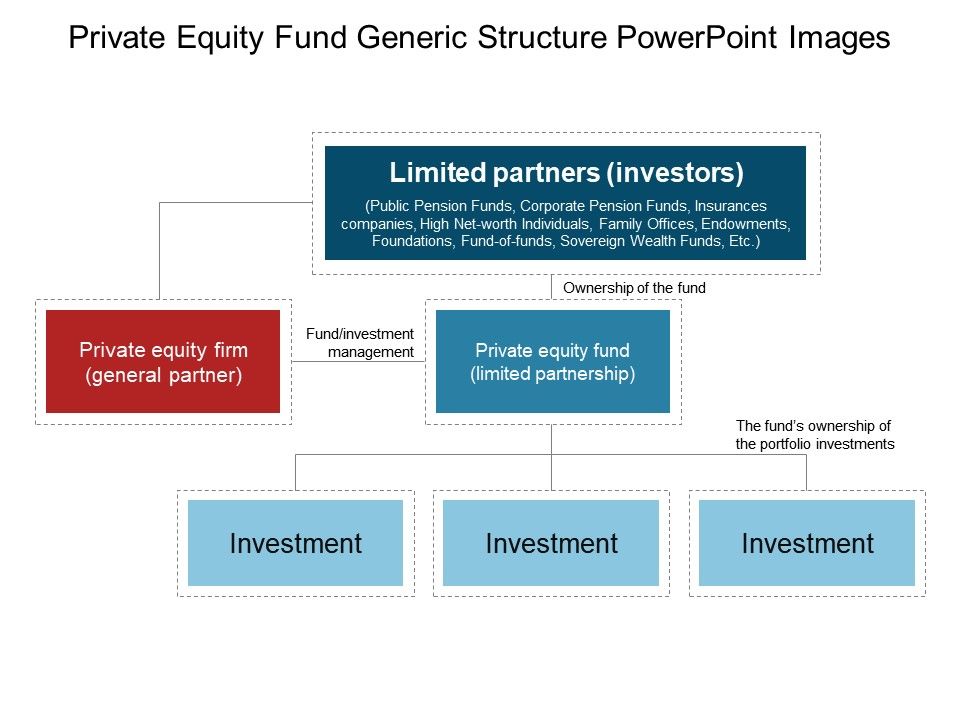

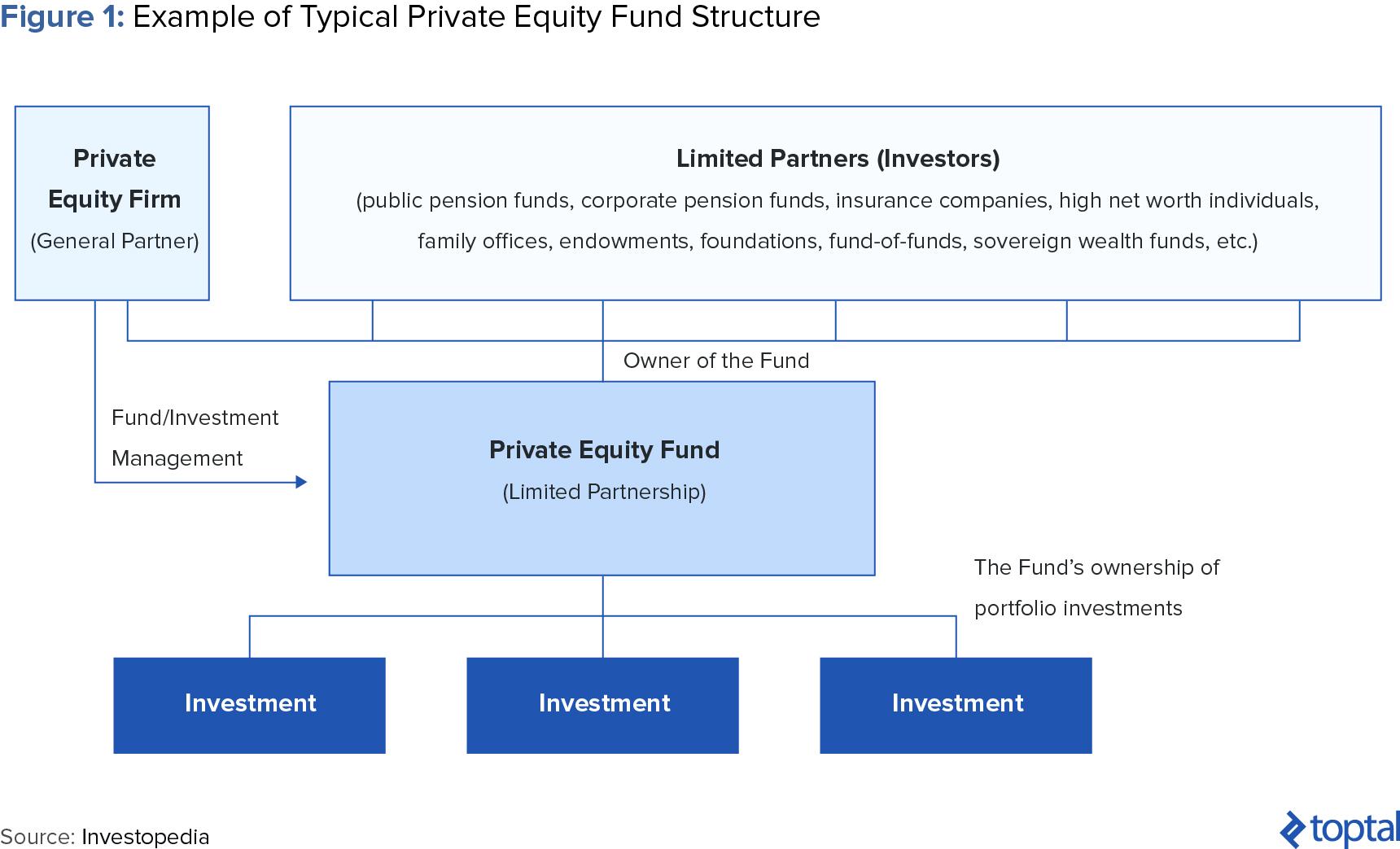

Private equity fund structure diagram. After a few years and usually after they have invested 70 of the capital from fund i they will start. To understand how private equity firms are structured its important to understand that the partners of a private equity firm comprise the general partner gp of a fund. There has been little work addressing the specifics of private equity structures and their implications for the operating and capital partners that invest in them.

A master feeder structure is a devicecommonly used by hedge fundsto pool taxable and tax exempt capital raised from investors in the united states and overseas into as a master fund. Private equity firms will receive a periodic management fee as well as a share in the profits earned carried interest from each private equity fund managed. It also examines the principal documents involved in forming a private equity fund.

In december 2001 evca issued a position paper on the structure of private equity investment funds which was reproduced in the private equity fund structures in europe paper published by evca in january 2006. Typically a single private equity firm will manage a series of distinct private equity funds and will attempt to raise a new fund every 3 to 5 years as the previous fund is fully invested. Private funds are investment vehicles formed by investment.

Private equity fund performance. It covers general fund structure fund economics fundraising fund closings and term managing conflicts and certain us regulatory matters. In private equity funds and joint ventures operating agreements between equity partners employ cash distribution rules that.

For example abc private equity firm will raise the fund abc capital partners fund i and begin deal sourcing and making investments acquisitions. This paper updates our position and restates our recommendations. Private equity firms with their investors will acquire a controlling or substantial minority position in a company and then look to maximize the value of that investment.

They obtain capital commitments from typically institutional investors known as limited partners lps. These funds are generally formed as either a limited partnership lp or limited liability company llc. Although minimum investments vary for each fund the structure of private equity funds historically follows a similar framework that includes classes of fund partners management fees investment.

A private equity fund is raised and managed by investment professionals of a specific private equity firm the general partner and investment advisor.

How Carried Interest Works In Private Equity Efinancialcareers

How Carried Interest Works In Private Equity Efinancialcareers

Figure 4 2 From Why Are Buyouts Levered The Financial

Figure 4 2 From Why Are Buyouts Levered The Financial

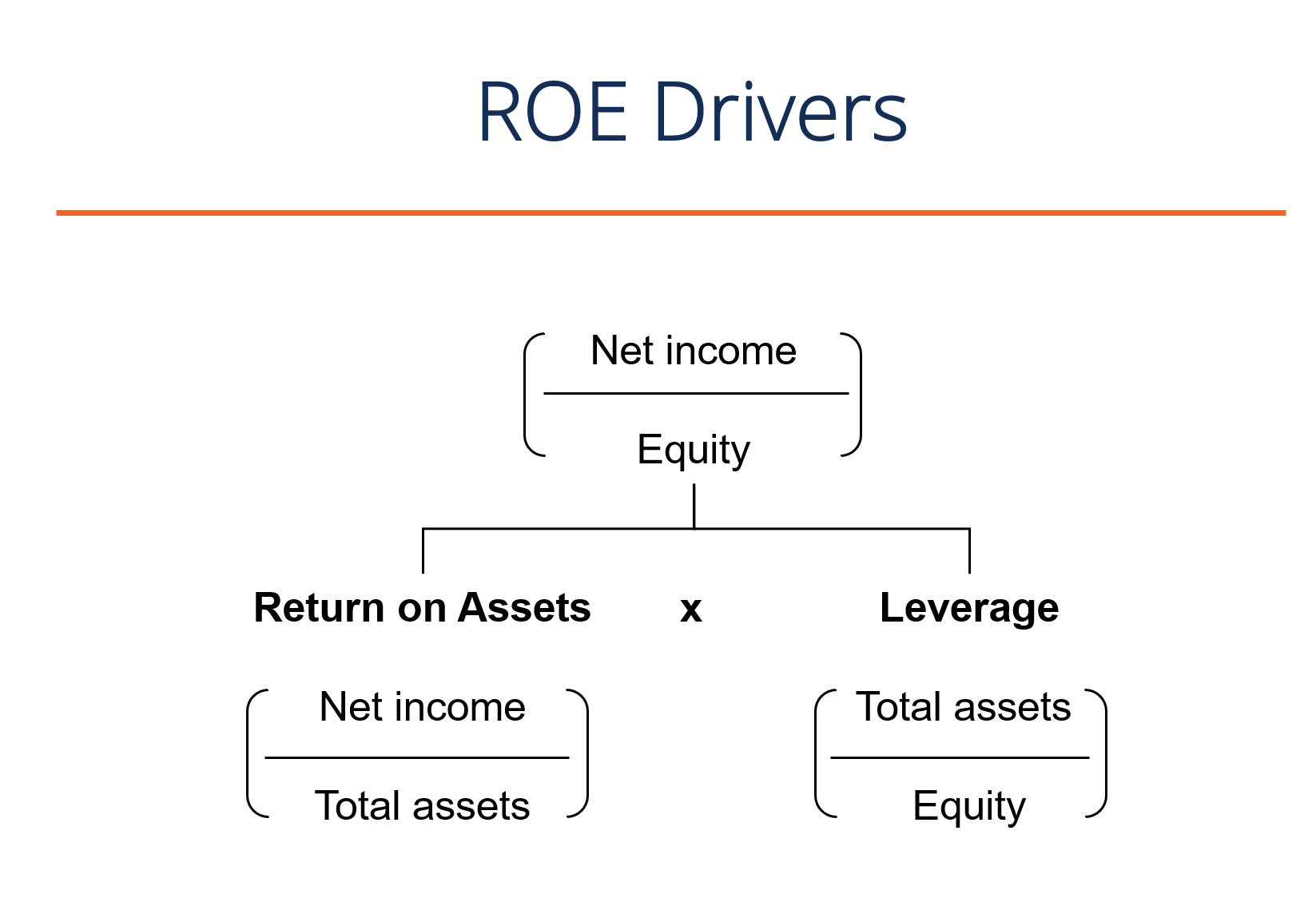

Private Equity Compensation Salary Average Private Equit

Private Equity Compensation Salary Average Private Equit

Five Questions On Global Parallel Fund Structures Brown

Five Questions On Global Parallel Fund Structures Brown

Lp Corner Us Private Equity Fund Structure The Limited

Vc Funds 101 Understanding Venture Fund Structures Team

Vc Funds 101 Understanding Venture Fund Structures Team

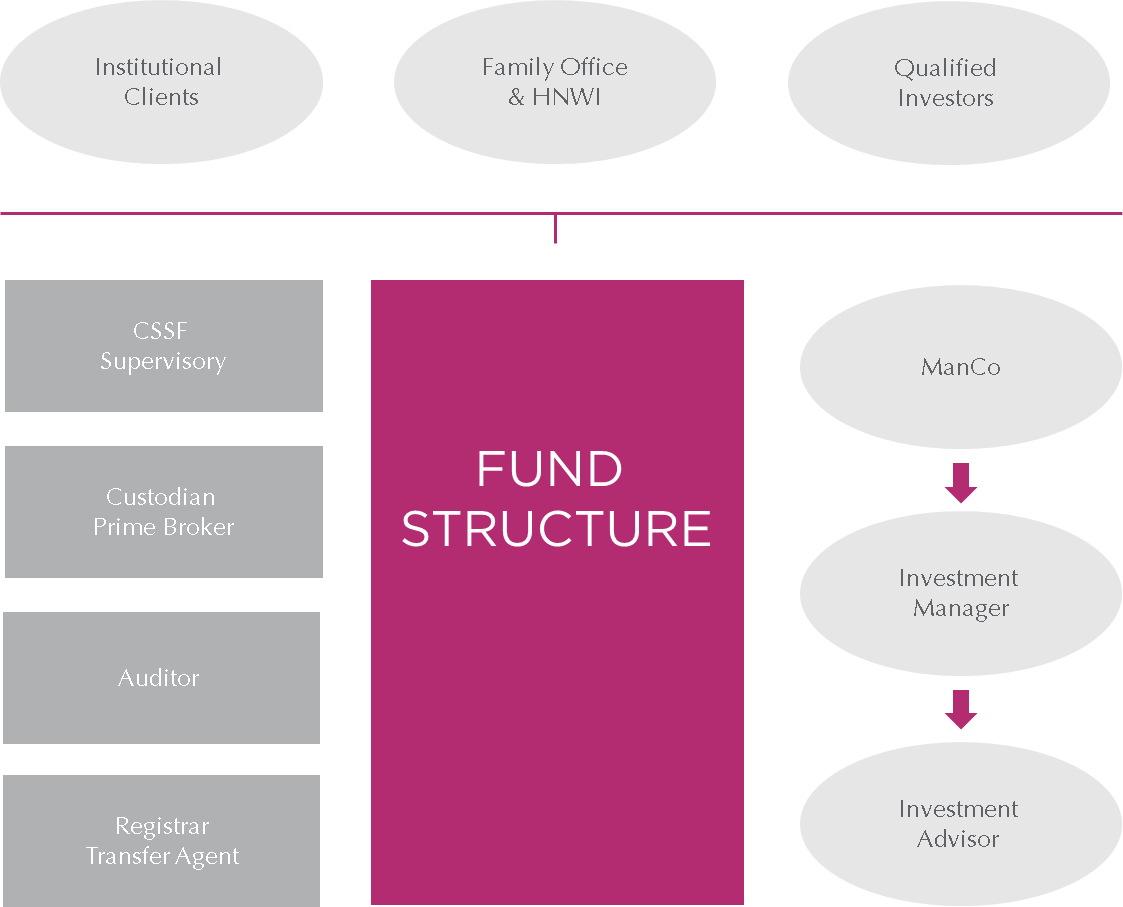

Expertise In Investment Funds Structures In Luxembourg

Expertise In Investment Funds Structures In Luxembourg

Diagram Of Equity Technical Diagrams

What Is Private Equity Overview Of Structure Deal

What Is Private Equity Overview Of Structure Deal

Private Equity Transaction Square

Understanding The Blackstone Partnership Structure

Understanding The Blackstone Partnership Structure

61591302 Style Hierarchy 1 Many 3 Piece Powerpoint

61591302 Style Hierarchy 1 Many 3 Piece Powerpoint

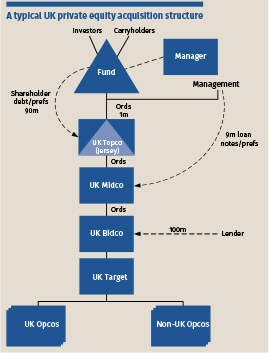

Tax Issues On Private Equity Transactions

Tax Issues On Private Equity Transactions

Private Equity And Venture Capital Investing In Asia

Private Equity And Venture Capital Investing In Asia

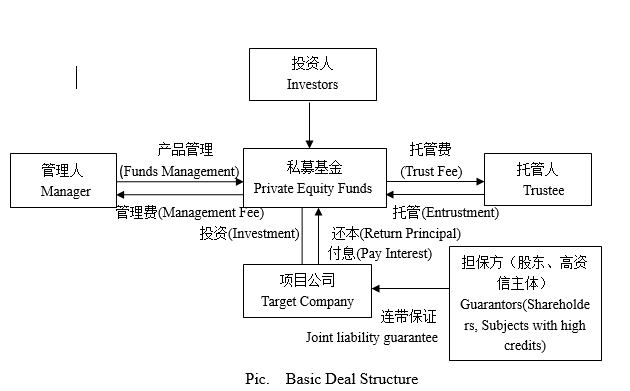

Optimal Transaction Structuring In China How Private Equity

Optimal Transaction Structuring In China How Private Equity

Chart Of The Week The Various Management Fees By Fund Type

Chart Of The Week The Various Management Fees By Fund Type

Equity Co Investment Wikipedia

Equity Co Investment Wikipedia

Presentation On Private Equity By Ca Sudha G Bhushan

Presentation On Private Equity By Ca Sudha G Bhushan

Preparing Fiduciary Income Tax Returns For Decedents

Marvelous Feeder Fund Private Equity Sleekster

How Kkr Structures Its Investment Vehicles Market Realist

How Kkr Structures Its Investment Vehicles Market Realist

Private Equity Industry Trends And Outlook For 2017 Toptal

Private Equity Industry Trends And Outlook For 2017 Toptal

liability insurance i never know the use of adobe shadow until i saw this post. thank you for this! this is very helpful.

ReplyDelete