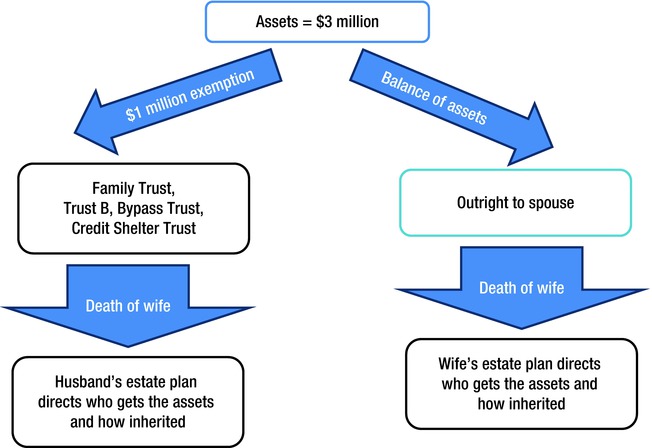

Credit Shelter Trust Diagram

Jun 14 2015 at 1216pm. A credit shelter trust is a type of trust fund that allows married couples to reduce estate taxes by taking full advantage of state and federal estate tax exemptions.

Planning Guide For Marrieds Springerlink

Planning Guide For Marrieds Springerlink

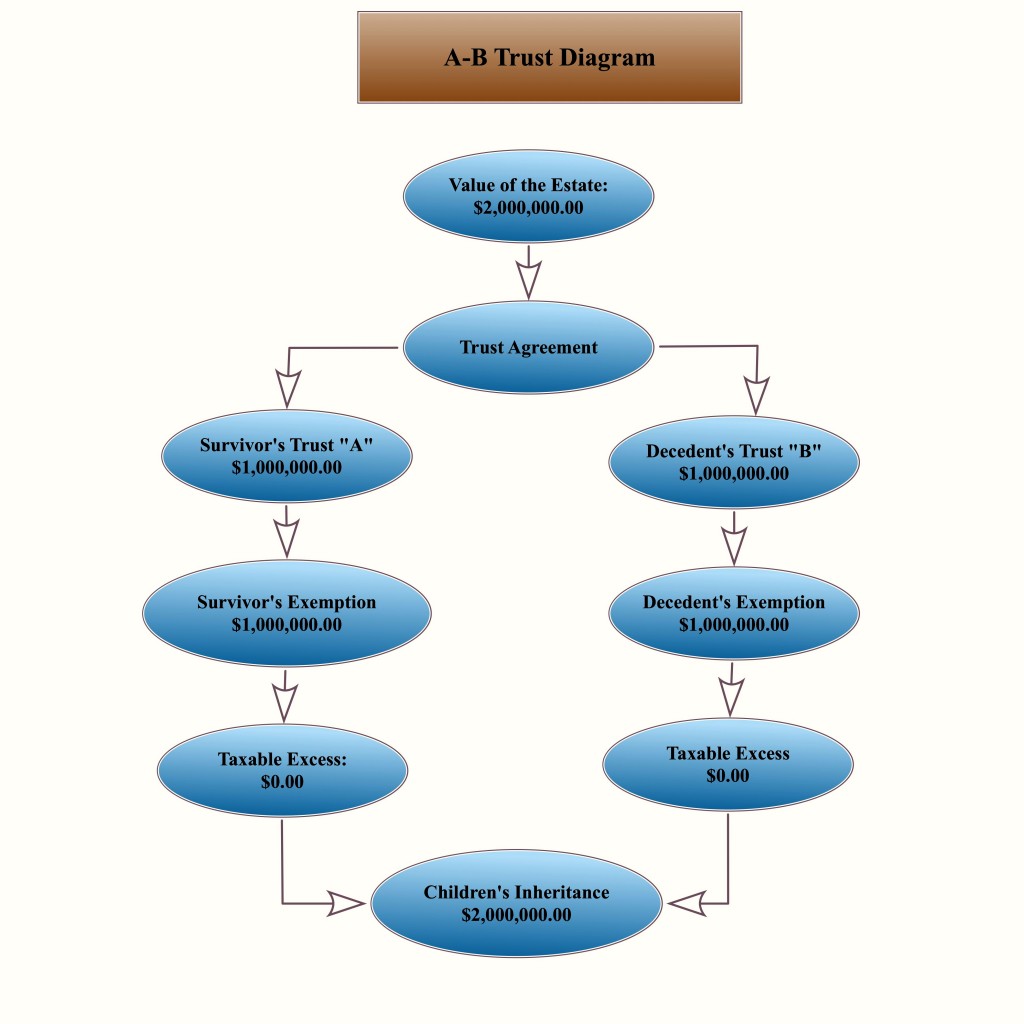

The b trust is also commonly referred to as the bypass trust credit shelter trust or family trust ab trusts and portability of the estate tax exemption note that beginning in 2011 the federal estate tax exemption was made transferable between married couples.

Credit shelter trust diagram. Although such trusts may appear needless unless you are a multi millionaire there are still reasons for those of more modest means to do this kind of planning and one of the main ones is state taxes. When the first spouse of a married couple dies he or she can pass all his or her assets to the surviving spouse free of estate taxes because of the marital deduction. A credit shelter trust is a legal entity frequently used to pass wealth on to beneficiaries.

This method has some advantages and disadvantages that you should know about before getting involved with it. A credit shelter trust is sometimes referred to as a bypass trust. This type of irrevocable trust is structured so that upon the death of the trusts creator or settler.

Spouse leaves everything to surviving spouse spouse leaves his or her half of estate in a credit shelter trust 4 million estate 4 million for surviving spouse 2835 million for children 15 million credit shelter trust 25 million 354 million for children no tax at first spouses death tax at surviving spouses death 1135 million at surviving spouses death trust assets pass to children tax free surviving spouses tax exemption reduces tax on his or her portion of estate. As such its generally only applicable in cases of multimillion dollar estates. Credit shelter trusts are a way to take full advantage of state and federal estate tax exemptions.

A bypass trust is sometimes known as a family trust or a credit shelter trust. The credit shelter trust is intended to allow married couples to take full advantage of the lifetime exemption for estate taxes and minimize federal tax on their combined estates. What is a credit shelter trust cst.

Such a trust can be used to shield assets in the event that a surviving spouse remarries and subsequently divorces. The credit shelter trust can be used to protect the assets from creditors. Here are the basics of the credit shelter trust and how you can use one.

But when the surviving spouse later passes on his or her estate will now be much larger because of. The credit shelter trust can be used to balance the needs of blended families. Attorneys at law trusted legal counsel for colorado families and their estate planning needs.

A credit shelter trust is designed to allow affluent couples to reduce or completely avoid estate taxes when passing assets on to heirs typically the couples children.

Unwinding An Irrevocable Life Insurance Trust That S No

Unwinding An Irrevocable Life Insurance Trust That S No

Page 1 Page 2 Page 3 Page 4 Page 5 Page 6 Page 7 Page 8

Page 1 Page 2 Page 3 Page 4 Page 5 Page 6 Page 7 Page 8

The Generation Skipping Transfer Tax A Quick Guide

The Generation Skipping Transfer Tax A Quick Guide

Credit Shelter Trust Bypass Trust

Credit Shelter Trust Bypass Trust

Current Tax Legislation And Estate Planning Practices

Current Tax Legislation And Estate Planning Practices

Advanced Estate Planning Beyond Wills

Advanced Estate Planning Beyond Wills

Estate Planning 101 Protecting Your Clients Assets

Exploring The Potential Of Tax Credits For Funding

Exploring The Potential Of Tax Credits For Funding

Estate Planning Charts And Diagrams With Private Label

Estate Planning Charts And Diagrams With Private Label

How Do The Estate Gift And Generation Skipping Transfer

How Do The Estate Gift And Generation Skipping Transfer

Estate Planning John And Mary Sample

An Ab Trust What Are The Benefits For Your Estate Baron

An Ab Trust What Are The Benefits For Your Estate Baron

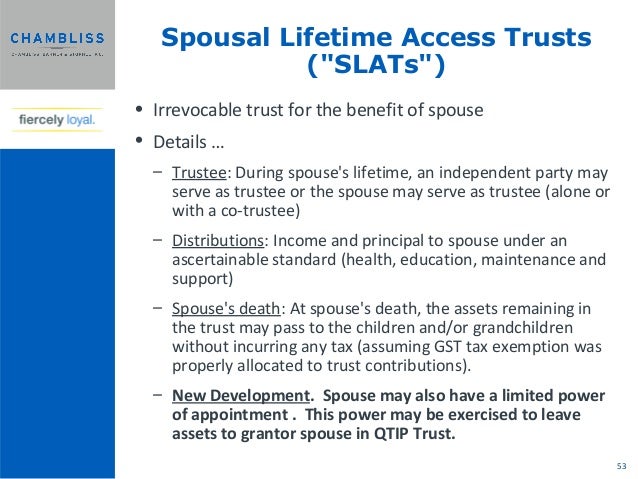

Ilits Slats Grats And Other Four Letter Words Ppt Video

Ilits Slats Grats And Other Four Letter Words Ppt Video

Corporate Tax In The United States Wikipedia

Corporate Tax In The United States Wikipedia

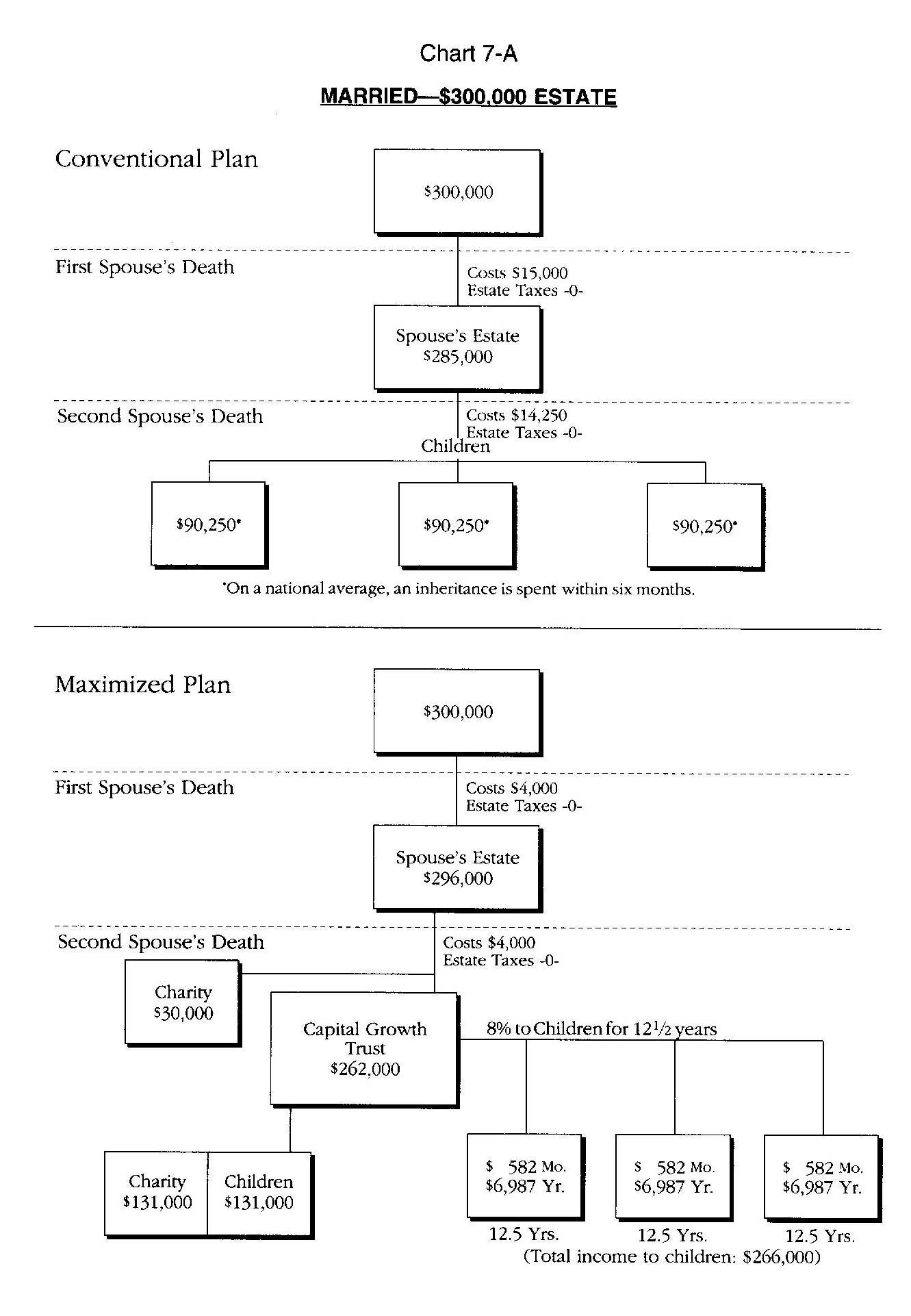

Finances By The Book Chapter 7 Trusts And Shelters Cbn Com

Finances By The Book Chapter 7 Trusts And Shelters Cbn Com

Venture Capital Trusts Part Four What Does The Investment

2010 Thompson Coburn Llp Back To Basics The Role Of

2010 Thompson Coburn Llp Back To Basics The Role Of

Understanding Qualified Domestic Trusts And Portability

Understanding Qualified Domestic Trusts And Portability

Multi Generational Planning Separating The Stickiness Of

Multi Generational Planning Separating The Stickiness Of

Chambliss 2014 Estate Planning Seminar Pptx

Chambliss 2014 Estate Planning Seminar Pptx

Wills And Trusts Baron Law Llc

Wills And Trusts Baron Law Llc

Integrating Estate Gifts Into Planning Integrating Estate

Integrating Estate Gifts Into Planning Integrating Estate

Asset Protection Strategies And Forms

Asset Protection Strategies And Forms

The Generation Skipping Transfer Tax A Quick Guide

The Generation Skipping Transfer Tax A Quick Guide

An Ab Trust What Are The Benefits For Your Estate Baron

An Ab Trust What Are The Benefits For Your Estate Baron

0 Response to "Credit Shelter Trust Diagram"

Post a Comment