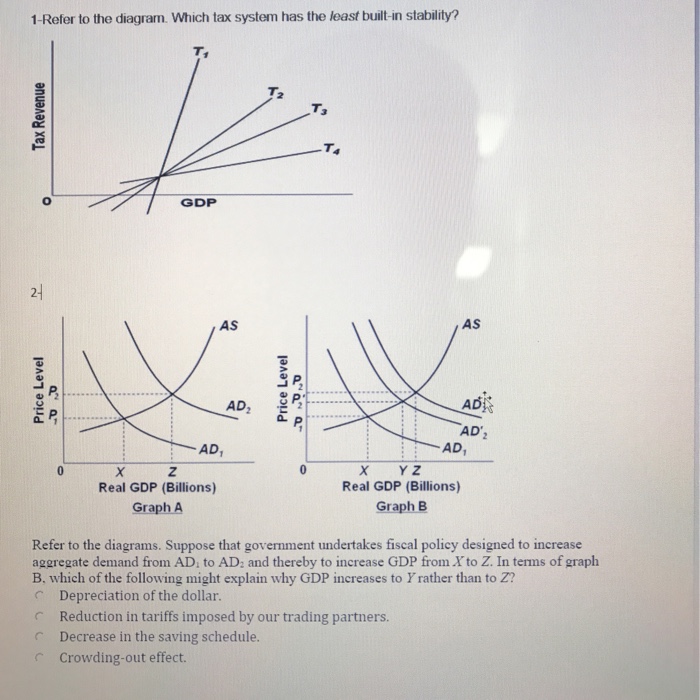

Refer To The Diagram Which Tax System Has The Least Built In Stability

This diagram portrays the notion of. Athe federal funds rate to fall to 35 percent.

The New Zealand Tax System And How It Compares

An expansionary fiscal policy.

Refer to the diagram which tax system has the least built in stability. Refer to the above diagram wherein t is tax revenues and g is government expenditures. Refer to the above diagram where t is tax revenues and g is government expenditures. All figures are in billions of dollars.

Refer to the above diagram. Refer to the above diagram which tax system has the. All figures are in billions of dollars.

A proportional tax also referred to as a flat tax impacts low middle and high income earners relatively equally. Which tax system has the least built in stability. Refer to the diagram.

Level 3 apply difficulty. Which tax system has the least built in. Advanced analysis refer to the above diagram in which c 1 is the before tax.

Cthe prime interest rate to fall below 40 percent. Refer to the above diagram. Use the following to answer questions 67 70.

A progressive tax has more of a financial impact on higher income individuals and businesses and less on low income earners. All figures are in billions. D question 21 3 pts t t2 t3 t gdp refer to the diagram.

Which tax system will generate the largest cyclical deficits. Refer to the above diagram. Bthe discount rate to fall.

Dbanks to become more cautious in lending. A t 4 b t 3 c t 2 d t 1 66. If the quantity of reserves rises from 100 billion to 150 billion we can expect.

If the full employment gdp is 400 billion while the actual gdp is 200 billion the. Refer to the diagram where t is tax revenues and g is government expenditures. Refer to the aloft diagram.

D question 21 3 pts t t2 t3 t gdp refer to the diagram. The shift of the aggregate demand curve from ad1 to ad2 is consistent with. Which tax system has the most built in stability.

30 02 explain the role of built in stabilizers in moderating business cycles. 2 medium learning objective. Which tax system will generate the largest cyclical deficits.

Refer to the above diagram. If the full employment gdp is 400 billion while the actual gdp is 200 billion the cyclically adjusted budget deficit is. Regressive taxes are those that have a greater impact on low income individuals than high income earners.

Refer to the above diagram for the federal funds market. Refer to the diagram in which qf is the full employment output.

The Socialist Empire The Incas Of Peru Foundation For

The Socialist Empire The Incas Of Peru Foundation For

China S Looming Crisis A Shrinking Population The New

China S Looming Crisis A Shrinking Population The New

Tax And Budget Policy Cato Liberty

Tax And Budget Policy Cato Liberty

The Economy Unit 14 Unemployment And Fiscal Policy

The Economy Unit 14 Unemployment And Fiscal Policy

The Daily 202 Democratic Candidates Keep Proposing Tax

The Daily 202 Democratic Candidates Keep Proposing Tax

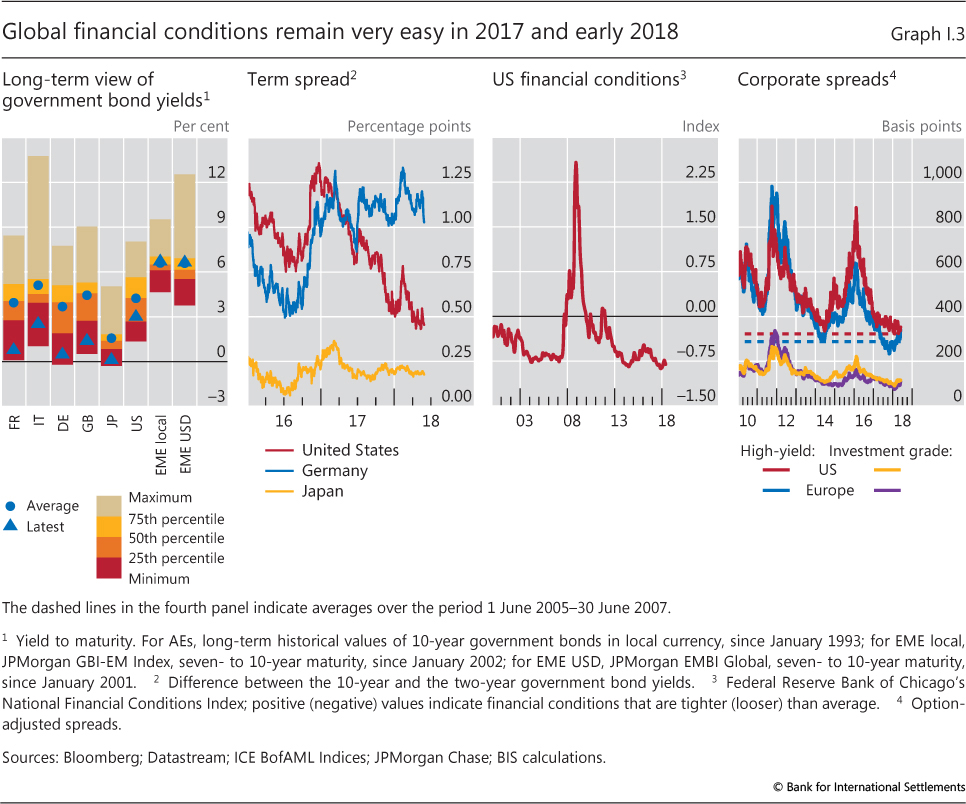

I A Stronger Expansion How To Make It Last

I A Stronger Expansion How To Make It Last

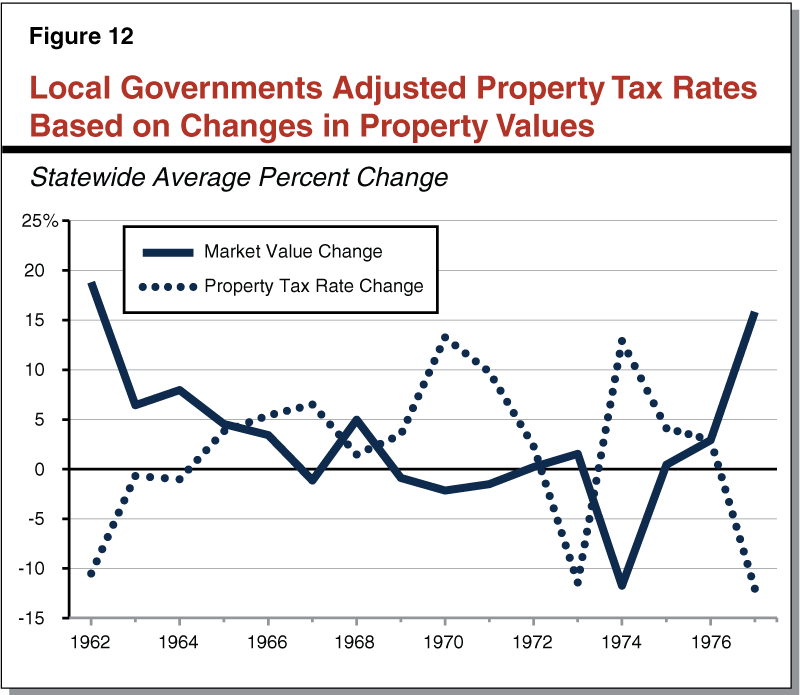

Common Claims About Proposition 13

Common Claims About Proposition 13

Bti 2018 Morocco Country Report

Bti 2018 Morocco Country Report

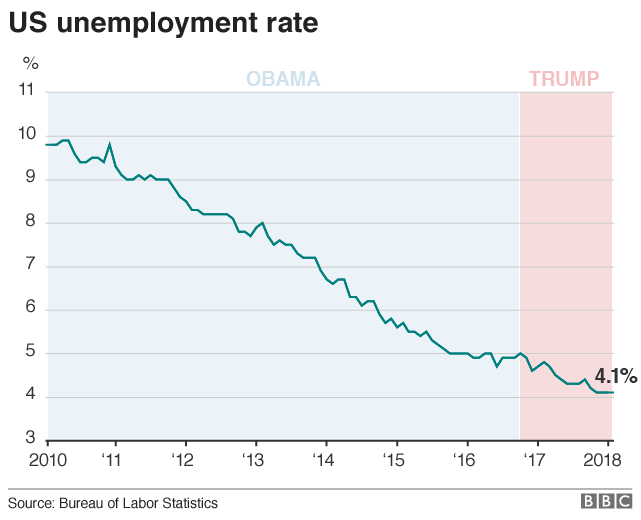

Donald Trump And The Us Economy In Six Charts Bbc News

Donald Trump And The Us Economy In Six Charts Bbc News

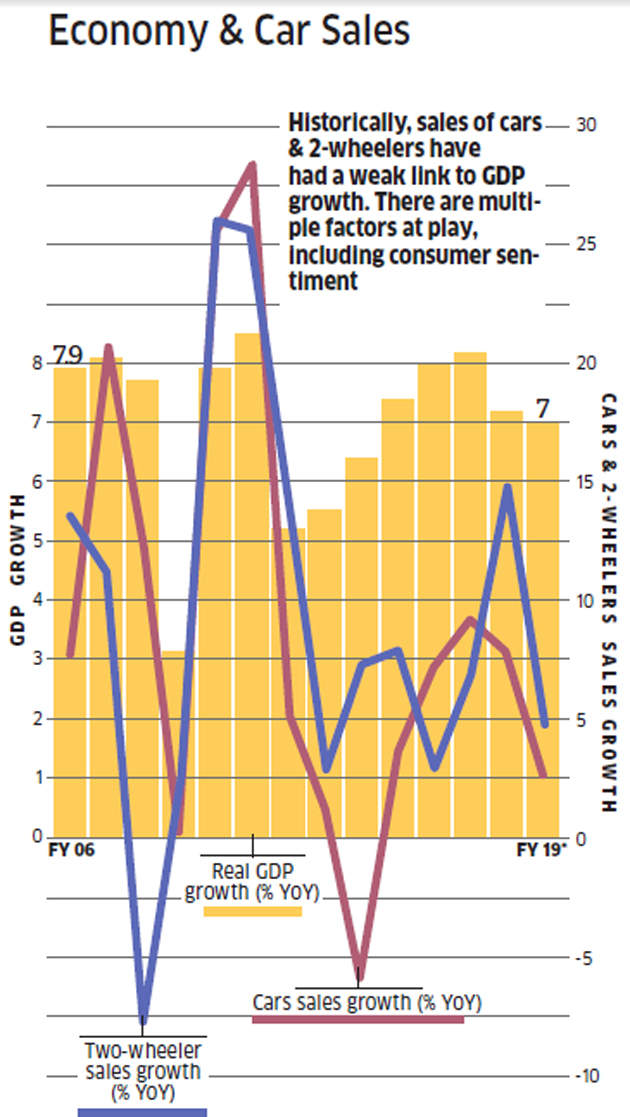

With India S Economy Growing At About 7 Why The Auto

With India S Economy Growing At About 7 Why The Auto

Who Really Pays Economic Opportunity Institute Economic

Who Really Pays Economic Opportunity Institute Economic

Ec1001 Question Sheet 1 Tutorial 1 Week 16

The Power Of Economic Freedom 2019 Index Of Economic

The Power Of Economic Freedom 2019 Index Of Economic

Global Leverage Examined Ft Alphaville

Global Leverage Examined Ft Alphaville

How Does A Welfare State Achieves Fiscal Sustainability A

How Does A Welfare State Achieves Fiscal Sustainability A

Alberta Carbon Tax Deep Dive Not A Job Killer Competitive

Alberta Carbon Tax Deep Dive Not A Job Killer Competitive

The Future Of Data Centers Cb Insights Research

The Future Of Data Centers Cb Insights Research

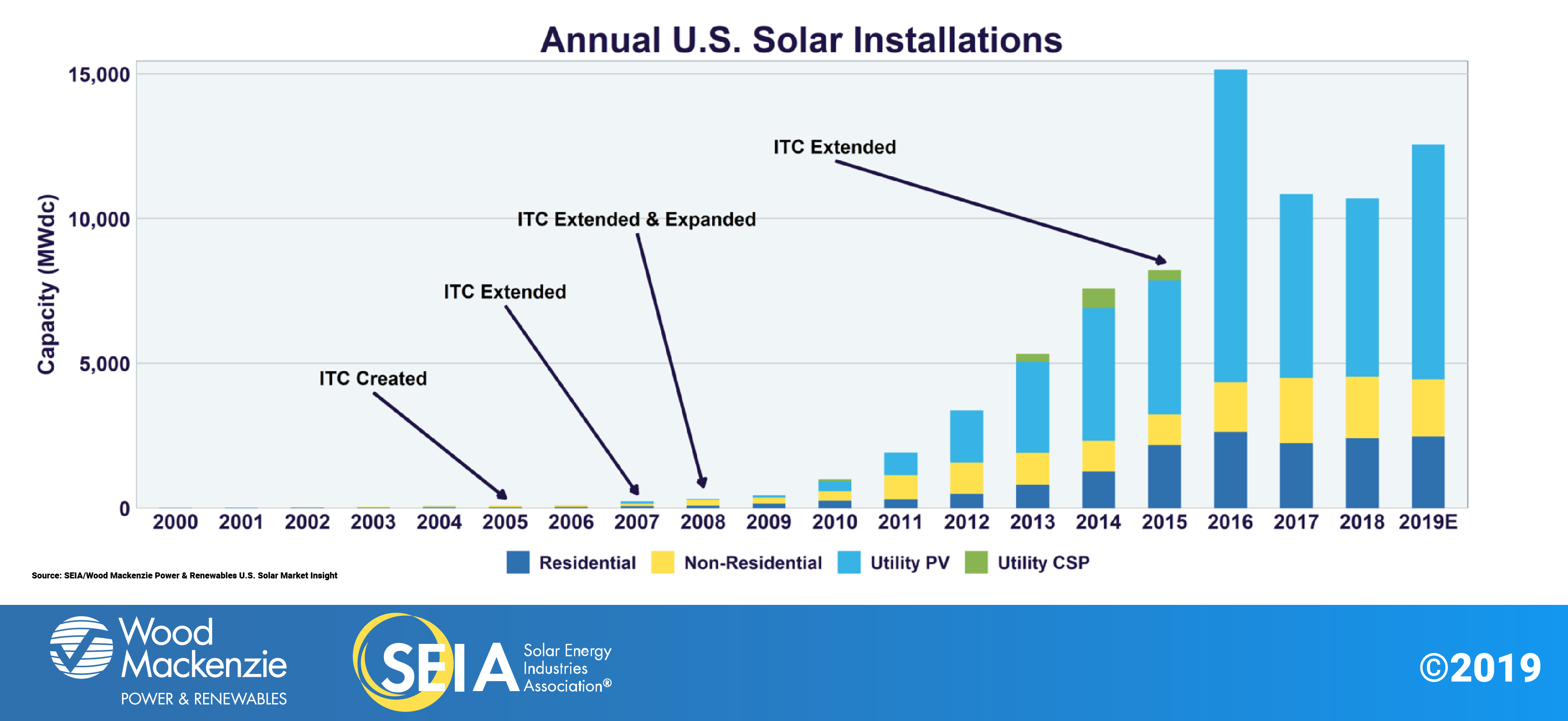

Solar Industry Research Data Seia

Solar Industry Research Data Seia

Erica Grieder Low Taxes Low Services A Texas Success Story

New Rift Over Rates Brews In Turkey As Inflation Falls Off

New Rift Over Rates Brews In Turkey As Inflation Falls Off

Module Price Index Pv Magazine International

Housing Market Trends 2019 The Ultimate Guide Opendoor

Housing Market Trends 2019 The Ultimate Guide Opendoor

0 Response to "Refer To The Diagram Which Tax System Has The Least Built In Stability"

Post a Comment